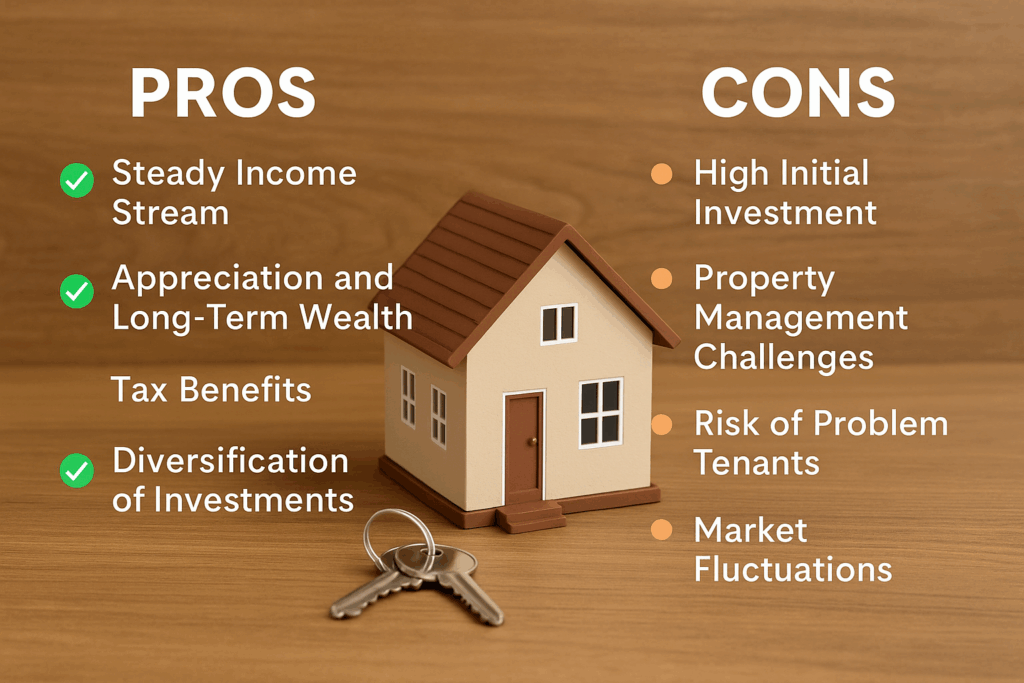

Real estate has long been considered one of the most reliable ways to build wealth, and owning rental property often tops the list of popular strategies. For some, it provides steady income, long-term appreciation, and a sense of financial security. For others, it can bring unexpected costs, tenant challenges, and management headaches. If you’re considering becoming a landlord, it’s important to weigh the benefits and drawbacks carefully. Here’s a detailed look at the pros and cons of owning rental property to help you decide if it’s the right move for you.

The Pros of Owning Rental Property

Steady Income Stream

One of the biggest advantages of rental property ownership is the potential for regular, predictable income. Rent checks from tenants can help cover your mortgage, property taxes, and insurance, and in some cases, even provide extra cash flow. Over time, as rents rise, your income may increase while your mortgage payment stays the same, giving you greater profitability.

Appreciation and Long-Term Wealth

Real estate tends to appreciate in value over the long term. While housing markets can fluctuate, most properties increase in value over decades. If you hold onto your rental property, you could benefit from both monthly rental income and the eventual appreciation of the property itself, building wealth in two ways at once.

Tax Benefits

Owning rental property comes with valuable tax deductions. Expenses such as mortgage interest, property management fees, repairs, maintenance, and even travel costs for managing the property can often be written off. Depreciation, a unique real estate tax benefit, allows you to deduct a portion of your property’s value each year, further reducing your taxable income.

Diversification of Investments

Many investors like real estate because it diversifies their portfolio beyond stocks and bonds. Rental property can act as a hedge against inflation since property values and rental prices often increase when the cost of living rises. This makes owning real estate a useful balance in a well-rounded financial strategy.

Control and Tangibility

Unlike many investments, rental property is something you can see, touch, and improve. You have control over which property you buy, how it’s maintained, and the type of tenants you rent to. This level of involvement appeals to people who want more control over their investments rather than leaving it all to market fluctuations.

The Cons of Owning Rental Property

High Initial Investment

Getting started with rental property requires a significant amount of money upfront. Between the down payment, closing costs, and potential renovation expenses, the barrier to entry can be steep. Even after the purchase, landlords must keep a financial cushion for repairs, vacancies, or unexpected costs.

Property Management Challenges

Managing tenants and maintaining a property can be time-consuming and stressful. From collecting rent to handling complaints and coordinating repairs, being a landlord is often more hands-on than new investors expect. Some owners hire property management companies to reduce the workload, but this comes with an additional cost that can cut into profits.

Risk of Problem Tenants

Not all tenants pay on time, treat the property with care, or follow lease agreements. Dealing with late rent, property damage, or even evictions can be costly and emotionally draining. While thorough tenant screening helps, there is always some level of risk when renting out property.

Market Fluctuations

Just as property values can rise, they can also fall. Economic downturns, neighborhood changes, or local job losses can impact both rental demand and property appreciation. Owning rental property ties up a large portion of your wealth in one location, which may be riskier than more liquid investments.

Ongoing Expenses

Even when a property is rented, landlords must budget for expenses such as property taxes, insurance, utilities (if not paid by tenants), and maintenance. Vacancies can add financial pressure since the bills don’t stop just because rent isn’t coming in. A broken furnace, leaky roof, or unexpected plumbing issue can quickly eat into profits.

Owning rental property isn’t for everyone. For those who are financially prepared, willing to put in the effort, and comfortable managing risks, it can be a powerful way to build wealth and create passive income. However, for those who prefer a hands off investment or don’t have the resources to weather unexpected challenges, the stress may outweigh the rewards.

The key is to be realistic about your goals, budget, and level of involvement. If you go into rental property ownership with a clear understanding of both the pros and cons, you’ll be better equipped to make smart decisions and maximize your investment.